第十九章 抓住超级行情的激动

The Thrill of Catching the Mega-Move

There may be some traders who can get all excited about the prospects of a month-long rally in yen or Swiss francs or a move in GNMAs or some other alphabet-soup assortment of financial futures. And I’ll concede that, as pragmatic traders, we focus on dollars and not on excitement or emotions. It shouldn’t much matter if we make our big money in soybeans or jellybeans. The important thing is that we make the big profits. That notwithstanding, all these financial futures combined can’t generate the kind of sheer raw excitement, the hold-your-breath roller coaster-like thrill of a big move in soybeans!

有些交易者可能会有这样的经验,也就是日元或瑞士法郎,或者是债券期货或其它的金融期货连涨一个月,让人兴奋不已。我要说的是,作为务实的交易者,重点是关注如何赚钱,不是关注兴奋或者个人情绪。我们到底是从黄豆上面赚到大钱,还是从软糖上面赚到大钱,其实都没什么关系。重要的是我们确实赚到了大钱。虽然如此,所有的金融期货加起来,都不能让人产生那么大的激情,只有黄豆的大涨大跌,才有令人暂时停止呼吸的感觉!

My first major play on Wall Street occurred in soybeans – the 1961 bull deal in Chicago. This market had all the ingredients to impress a freshman Merrill Lynch account executive recently arrived from the firm’s six-month training program. And, although Merrill had spent a small fortune teaching me all aspects of the financial business, the rest of the products in my sales kit paled by comparison with the action in futures. I knew that I was hooked when I found myself walking into the corner office of Sam Mothner, my office manager and mentor, reintroducing myself as, “your new commodity specialist.” A brief discussion ensued in which he did most of the discussing! He tried to talk me out of this crazy notion. But I was adamant, and he was sufficiently experienced to realize that his new 27-year-old account executive was very committed. I was thrilled when I left his office some 20 minutes later as the new commodity specialist.

我在华尔街第一次玩得直呼过瘾的事,是发生在黄豆上面——1961年的芝加哥多头市场。这个市场具备了所有的条件,能让美林公司新进的业务员我留下深刻的印象。那时我刚接受了6个月的培训课程,来到芝加哥。虽然美林公司花了不少钱教导我金融行业的所有知识,我的工具箱里的推销产品,跟期货的趋势比起来,还是相形失色。我走进萨姆·马斯勒的主管办公室时,我知道,自己已经上钩了。马斯勒是我的上司,也是我的导师。我自我介绍:“新来的商品专员报到。”简短的交谈后,我们又谈了很久,而且几乎都是他在讲话!他设法驱逐我脑中一些不正确的想法。但是我十分固执,他大概可以感觉得出来,这位27岁的新进业务员还是有决心的。约20分钟之后,我离开了他的办公室,走马上任,当新的商品专员时,心里很激动。

Over the years, I’ve made it a point to get to Chicago for a day or two on the floor each time there was a boiling soybean market. I never tire of witnessing this spectacle, perhaps the most exciting floor action on any exchange. On one memorable occasion, I watched in awe as a young floor broker from one of the commission firms entered the bean pit with a large buy order during a violent price reaction. The market seemed to be plummeting into a black hole, and his was the only bid in the pit at that moment. The action was fast and furious, and the young broker bought his million-or-so beans in record time. Seconds later, he staggered down the littered steps of the bean pit to the relative quiet and security of his firm’s telephone booth. His trader’s floor jacket had been slightly altered by the crowd of sellers who had descended on him like piranhas. There he was, still in a slight daze, minus his two jacket sleeves. They had been wrenched right off his limp jacket by several screaming and gesticulating colleagues eager to help the young broker buy all the beans they were trying to sell. I’ll never forget that day – I’ll bet he won’t either.

这些年来,每当黄豆市场沸腾不已的时刻,我总是坚持要到芝加哥营业现场待一两天。那幅奇观,我百看不厌,也许没有一个交易所像这里有那么激情的演出。我印象深刻的一次记忆中,曾惊愕莫名地看着某经纪公司一位年轻的营业厅经纪人,在价格狂跌的时刻,带了一笔很大的买单,跑到黄豆柜台前。当时价格似乎要暴跌到无底洞,他的买单是唯一的买单。他的行动十分迅速和猛烈,以创纪录的时间买入了一百万左右的黄豆。几秒后,他十分吃力地走下黄豆柜台前乱成一团的台阶,走到他公司相当安静和安全的电话亭。一大堆叫卖的人跟在他屁股后面,把他所穿的营业厅交易者夹克给扯歪了。他还没回过神来的时候,夹克上的两只袖子已经不见了。但是大家还是不肯放过他,抢拉着那件已经破烂的夹克,高喊并打手势,希望那位年轻的经纪人买下他们想卖的所有黄豆。我永远忘不了那一天——我敢说他也忘不了。

In 1975, after 16 years in the front-line trenches of futures trading, I had been in more than my share of big moves – for big profits and big losses. I’d made a few killings and had been the victim of quite a few. They ran the gamut from agriculturals and meats to softs and metals. I was 41 years old, had attained my goals, both personal and financial, and felt that I needed a long and leisurely break. So I took a five-year sabbatical, during which I studied, wrote, and traveled. I tried to avoid thinking of the markets altogether. But any time I heard of big action in beans, I felt a quickening of the pulse, a flush of the temple, and a twinge of anxiety. This stuff gets into your blood.

1975年,在期货市场冲锋陷阵16年之后,我自己亲自战斗的次数太多了——这其中,有大赚,也有大亏的时候。我在市场中大显身手,也在很多市场尝过败绩。这些市场有农产品、肉类、软货,也有金属。那时我41岁,不管是个人还是金钱上,都已达成目标,觉得自己需要一段长时间的休息,松懈身心。所以我销声匿迹了5年。这段期间内,我读书、写作和旅行。我试着把期货市场完全抛诸脑后。但是每当我听到黄豆市场又有行情,总是觉得脉膊加快,太阳穴冲血,焦虑刺痛心头。这种感觉,深入血液。

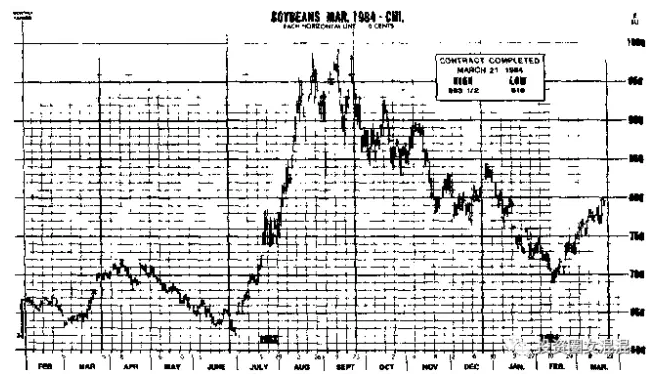

In August of 1983, back on Wall Street, I ventured to Chicago for my personal homage to King Bean. The market had, once again, confounded the experts by soaring through the roof at a totally unexpected time. There had been a modest rally from January through April, punctuated by a brief reactionary pause during February (there’s the February break again). The April advance stalled at 7.20 (basis March 1984 future) and then collapsed into a 10-week slide right down to new contract lows around 6.20. A bear market shaping up, right? Wrong! Following this big break, around the first week in July, the bean market commenced a modest advance lasting just 11 weeks. It carried values up to 9.90 for a whopping move of over $18,000 on just $1,500 margin. Talk about big moves and megaprofits! And, during that bull move, especially above the 9.00 level, the rallying cry among the Chicago bean watchers was “beans in the teens.” Well, it didn’t quite make that level; the market topped out just short of $10.00 (basis March future) and spent the next several years in full retreat (see Figure 19-1).

1983年8月,我回到了华尔街,马上跑到芝加哥,向黄豆大王膜拜。当时,市场又叫很多专家困惑,因为价格在完全出乎意料的时间一飞冲天。1月到4月有温和的反弹趋势,2月间曾短暂回调,稍事喘息(又是2月小憩)。4月的涨势在7.20受阻(基期1984年3月期货),然后溃败,连跌10周,跌到合约期新低价6.20左右。空头市场成形,对吧?错了!这一段大回调之后,7月第1周左右,黄豆市场发动了温和的上涨趋势,只持续11个星期。但是就在这短短的15个星期内,价格涨到9.90,只要1500元的保证金,就能赚到18000元之多。这一段可说是大行情加超级利润!而且,在这段多头趋势里,特别是在9.00之上,涨势之锐利,密切注意芝加哥黄豆的人都说:“黄豆破10元之日可待。”嗯,实际情况倒是没有那么多;价格接近10.00元(基期3月期货)就做头反转,接下来几年则节节败退。(见图19-1)

图19-1 1984年3月黄豆

【The market once again confounded the soybean watchers by soaring through the roof following a collapse to the 6.20 level in early July. Talk about dynamic moves. This bull deal advanced from 6.20 to 9.90, a move of some $18,000 per contract, in just three months Although the Chtcago boys kept chanting, “beans in the teens,” they never quite made it to double digits The next three years were spent wroth the soybean market in full retreat.

7月初价格暴跌到6.20之后,黄豆价格竟一飞冲天,又叫很多密切注意黄豆行情的专家困惑。这是段动能十足的趋势,价格从6.20涨到9.90,仅仅3个月内每份合约涨了约18000元。虽然芝加哥的人仍在高唱黄豆破10,黄豆价格却没涨到10元以上。接下来3年,黄豆市场节节败退。】

If you get the feeling that soybean watchers start chanting, whistling, and stomping every time they see a 40- or 60-cent rally, looking for another $2 or more, you’re absolutely right. Matter of fact, they are joined in their “bull dance” by a consortium of mostly Midwest merchants who deal in luxury tangibles such as homes and apartments, boats, cars, and jewelry, A bull move in soybeans, with its vast public and professional participation, typically creates more new millionaires and solidifies more existing ones over a relatively brief period of time than a major move in any other commodity. Regrettably, quite a few of these instant millionaires fall off the ride when the market turns south and prices plummet even faster than the original rally. Anyone in the market for a pre-owned yacht, limousine, Rolex watch, or Chicago lakeside condo should coordinate his purchase with the final stages of a bull market washout in soybeans.

如果你发现密切注意黄豆的人因为价格涨了40或60分,而开始唱歌、吹口哨、手舞足蹈,再赌黄豆会涨个2元或更多,绝对是对的。事实上,参加“多头之舞”的人,还有中西部的商人。他们会买一些豪华的有形资产,像是房子和公寓、游艇、汽车和珠宝。黄豆的多头趋势,由于参与的大众和专业人广泛,即使很短时期的涨势,制造出来的百万富翁,也比其它任何商品的大行情制造的多,而且能使原来的富翁更为有钱。遗憾的是,当价格突然下跌时,由于下跌速度比上涨时还快,很多临时的百万富翁都没来得及逃出来。当黄豆的大跌结束后,那些想买二手游艇,豪华轿车,劳力士,芝加哥湖边别墅的人真的要重新计算一下自己的资产。

Hardly any futures trader needs to be convinced about these two points: (a) If you’re lucky or skillful enough to catch the top or bottom of a market that develops into a major move, and if you’re lucky or skillful enough to stick with the position for the majority of the move, and if you’re lucky or skillful enough to limit losses on your other positions, you’re going to make a lot of money. (b) If you make a lot of money, as in (a) above, you’re going to have one hell of a time spending it. Any dissenters? I can give firsthand personal testimony verifying these two truths.

期货交易者很少需要别人提醒下面两点:(a)如果你运气够好或者技术高超,逮到了某个大趋势市场的头部或底部,而且如果你运气够好或者技术高超,能够在趋势的大部分时刻持有原来的仓位,而且如果你运气够好或者技术高超,能够控制其它仓位的损失的话,你一定会赚很多的钱。(b)如果你像(a)所说的那样,赚了很多的钱,你一定会找个时间大把花钱。有没有异议?我可以给人第一手的个人亲身证词,证明以上两点所言不假。

Clearly, the issue is not how to spend the big winnings. We can all figure out how to do that. Rather, it’s how to snare the big winnings. You can’t do it on the basis of market gossip, tips, or because you may have lost money on your last 5 or 10 campaigns and the law of averages now favors you as a winner. To make a big score, your best bet is a disciplined and carefully calculated long-term campaign with a strategic plan guiding the entire operation.

很明显,问题不是如何去花赚来的钱,我们都知道如何花钱。真正的问题,在于如何赚到大钱。你没办法根据市场上的小道消息做到这一点,你也不能因为之前5次或10次战役你都败北,你就以为以概率论来说,这次赢的概率大多了。要赚大钱,最好的赌注是严守纪律,以策略性计划指导整个交易,小心计算好长期的操作。

How about luck as an ally? You might win one tennis or chess game due to luck. But can you imagine winning a major tennis or chess tournament, covering quite a few contests, on the basis of luck? I hardly think so. Likewise with futures, you need a well-organized and detailed strategic plan covering all contingencies, executed in a pragmatic and disciplined manner.

可不可以把运气当做好朋友呢?你可能因为运气好而赢得一场网球赛或象棋比赛,但是你看过因为运气不错,只较量了几次,就拿到重要的网球或象棋锦标赛冠军吗?我很难想象有这种事情发生。同样的,在期货市场里,你必须有良好的规划和详细的策略性的计划,考量所有的紧急状况,并以踏实和有纪律的方式执行。

As an example of a detailed strategic battle plan, I would like to share with you the strategic plan that I prepared in early 1987 for dealing with the silver market. Objective: megaprofits or modest losses. Such a plan, covering the various aspects detailed below, should be structured for every major position you take for the big move.

谈到详细的策略性战斗计划,我愿意拿1987年初我交易白银市场所准备的策略性计划,来跟读者分享。我当时的目标是:要么就大赚一票,要么就小亏一点。这个计划包含了下面会详细说明的各个层面,而且每个大行情来临时,你都该针对你的每一个大仓位,做这样计划。

The major trend is still down, with long-term support likely between 5.00 and 5.50 and overhead resistance toward the 8.00 level (see Figure 19-2). The intermediate trend, on the other hand, is sideways, and I project buying support on reactions towards 5.00 and resistance around 6.00, at 6.50 and again at 7.00, basis nearest future weekly close.

当时主趋势仍然下跌,长期支撑可能在5.00到5.50之间,上档压力在8.00附近(见图19-2)。中期趋势是横向盘整,根据最近期期货周收盘价分析,跌到5.00附近会有买盘进场支撑,6.00、6.50和7.00附近有压力。

图19-2 白银(最近期期货)长期周线图

【The major trend is down, and the intermediate trend is sideways. The market should find long-term buying support on reactions toward the 5.00-5.50 level. A close over 6.50 (nearest future) should turn the intermediate trend to up, and a close over 7.10 should turn the major trend to up.

主趋势下跌,中期趋势是横向盘整。回调到5.00——5.50时,应该会有买盘支撑。收盘价超过6.50(最近期期货)应该会使中期趋势转而向上,收盘价超过7.10,应该会使主趋势转而向上。】

So how to play this market? For anyone willing and able to stand the considerable financial and emotional risks, the significant play could be from the long side. Since making its major top at 14.00 in early 1983, the market has retreated to deep within a substantial long-term base area and, following an extended sideways consolidation period, should ultimately pop out of this area on the upside.

这么一来,这个市场要怎么玩?凡是愿意和有能力冒很大风险和情绪风险的人,最有可能是做多。1983年初主趋势在14.00做头以来,价格跌得很深,跌到相当的长期底部中,而且,在盘整期一延再延之后,市场最终会向上摆脱这个区域。

The key word here is ultimately. It’s hard enough to project where a market will go-but when is virtually impossible. In fact, it’s in the pursuit of the elusive when that so many traders, including experienced professionals, come to grief. To put this in perspective, we have only to look at the many bullish silver studies and trade recommendations that bombarded us during 1985. Yet the market registered life-of-contract lows during first-half 1986-making a hash out of every one of those impressive bullish advisories.

这里的关键字眼是最终。要预测市场向哪个方向走是十分难的——如果要预测何时会动,更是不可能。但是还是有很多交易者,包括经验丰富的专业人士,却为了“何时”的问题大伤脑筋。要说明这点,我们只要看看1985年疯狂给我们推销多头白银市场的研究报告和交易建议就可以了。但是市场在1986年上半年创下合约期新低价——那些大言不惭的看涨建议自此阵脚大乱。

How would I play this silver market? I would start with the premise that it is virtually impossible to accurately predict where silver or any other market will be trading at any future time. My strategy, then, is to structure a series of consecutive tactical moves in which I advance to each stage only after each previous stage has performed according to the scenario. This method should minimize the excessive risks of the operation, controlling them to an acceptable degree.

我要在白银市场里怎么玩?一开始,我就有个前题,那就是准确地预测将来什么时候白银或其它任何市场交易价格在哪里,是几乎不可能的事。于是我的策略是组织一系列连续性的战术行动,只有在前一个阶段按照我的假定发生之后,我才会进到下一个阶段。这种方法可以把交易所发生的额外风险降到最低,控制它们在可以接受的程度内。

The opening stage in my strategy is to begin accumulating a long silver position toward the long-term 5.00-5.50 (basis nearest future) support area. Now, assuming that this support level holds – and at this early stage in the operation we have no assurance that it will – we then move to the second stage; that is, we buy an additional silver increment on a weekly close (nearest future) above 6.50. Assuming the market continues to follow this generally bullish scenario, we buy a third increment on a weekly close (again, nearest future) above 7.10. At that point, I would project that the intermediate trend had turned up on the 6.50 close and also the major trend on the 7.10 close.

我的策略跨出的第一步,是在价格跌向5.00——5.50(基期近期期货)支撑区时,积累白银多头仓。现在,假如这个支撑水准守住了——在这个交易初步阶段,我们难以保证它会发生——接着我们走到下一步;也就是,如果碰到周收盘价(最近期期货)超过6.50时,再加仓买入白银。假如市场继续按这个多头趋势往前移动,碰到周收盘价(也是最近期期货)超过7.10时,第二次加仓。这个时候,我研判中期趋势在收盘价冲破6.50时已转为向上,主趋势则在收盘价格向上突破7.10时转为向上。

My price projection for the move? Should the market follow my scenario, I would expect an initial price objective of 6.80-7.00 (basis nearest future, weekly close) with an intermediate objective further down the line in the 9.50-10.50 range. Regarding any long-term price projection – it’s just too early to think about that at this time. My time projection for the move? From four months to two years. Actually, the time projection is the least exact and least relevant aspect of this analysis. Obviously, patience is a clear requisite to play this game.

我对价格趋势的预测如何?要是市场依我假设的设想移动,我预想初步的价格目标是6.80——7.00(基期最近期期货,周收盘价),中期目标更进一步到9.50——10.50间。至于长期价格预测——在这个时候,谈这件事未免过早了些。我对趋势的时间预测如何?在4个月到2年内。事实上,时间的研判是这个分析中最不准确和最没有关系的因素。很明显的,要玩这个游戏,耐心是必要的前提。

Despite the foregoing, we must acknowledge that the major trend is still sideways to down. Accordingly, the odds still favor a continuation of the ongoing bear trend. In essence, we are trying to bottom-pick within a strongly entrenched bear market, and that’s no easy task. Clearly, at this indeterminate stage, this is not a selection for the faint of heart or purse.

虽然前面说了那么一大堆,我们还是必须承认,主趋势依然是盘整偏弱。因此,原来的空头趋势持续下去的概率仍然大些。基本上,我们现在是在稳固的空头市场里抄底,而这不是件简单的工作。很明显的,这个不确定的阶段,不是心智薄弱和财力不够的人所能面对的。

That's all that need be said about the strategy at this point with one exception. What if the market heads south, instead of north the way it’s supposed to go? Have you heard the one about the professional speculator who lost $18,000 per contract on a big long silver position a few years ago? I have because I was his broker – and he’s the one who waited to buy until he knew that the big boys were in there buying. Big boys notwithstanding, this silver market is one helluva fast and leveraged game, and the stakes are high. So, unless you are a first-class masochist or have an uncontrollable desire to get a genuine tax loss named in your honor, you’d better have a bailout plan ready. That translates into a stop-loss point to take you out at your personal pain thresh-old, perhaps around the $1,200 to $2,000 per contract loss limit. And, if you get stopped out, you might take another shot at the long side on a further decline to the 4.00 to 5.00 level. Adhere to the rest of the scenario by adding to the position in increments with the on-close buy stops.

在这个时候,我们已把所有该谈的策略都说过了,只除了一点。要是市场继续下跌,而不是我们预计地上涨时,该怎么办?你有没有听过几年前,有位专业投机者做了个很大的白银多头仓,每份合约亏掉了18000元?我知道有这件事,因为我就是那个人的经纪人——他是那个等听到其他大户都在买入才买入的人。不管是不是大户,白银市场都是个变动十分迅速,杠杆比例极高的市场,所下的赌注非常高。所以说,除非你是个一流的受虐狂,或者有无法控制的欲望,真的想在自己名下制造所得税方面的亏损,否则你最好准备好应急计划。也就是说,你一定要设定止损点,在个人达到极度痛苦前,利用止损把自己带出场,比如说,在每份合约亏损到达1200或2000元左右时,就要出场。而且,如果你确实因为止损而出场,你还是可以在价格跌到4.00到5.00时再做多。同时,你要照着我们所说的假设中其它部分去做,利用收盘价的买入止损点加仓交易。

That's my long-range strategic plan for silver, prepared February of 1987. Let’s examine some of its particulars:

这就是我在1987年2月,针对白银所准备的长期策略性计划。我们来看看其中一些特别的地方:

1. The most obvious aspect is that the major trend is sideways to down and I am looking to buy the market-a violation of trend-trading dogma. However, the intermediate trend is sideways, and two of the long-term early warning systems that I follow have flashed buy signals for silver. Moreover, the market has achieved its down-side count and has fallen into an area of strong long-term technical support around the 5.00 level. And I do have efficient stops under the position that would limit losses in the event the downtrend continues.

1. 最显而易见的层面,是主趋势呈现横向盘整,但偏弱,而我等着要买入——这个想法违背了顺势交易的教条。但是中期趋势是横盘,而且我所用的两个长期早期预警系统,已经亮出了白银的买入信号。再说,市场已经跌了不少,掉到5.00附近强烈的长期技术支撑区内。我也为防万一,为免下跌趋势继续下去,设立仓位时也设置了很有效率的止损点,用以控制亏损。

2. Will the downtrend continue? I have no idea. If it does, I’m out of the market with a modest loss. If it turns up, out of the long-term base area, this step-by-step strategic scenario could result in exceptional gains. I would project that the profit potential is greater than the risk by a sufficient multiple, making the play worthwhile.

2. 下跌趋势会持续下去吗?我没有把握。如果真的继续跌下去,那我会带着不大的亏损出场。如果趋势是上涨,脱离了长期的底部区域,那我一步紧跟一步的策略性设想可能会带来很可观的利润。我估计获利潜力比风险高出很多,值得一赌。

3. Is this scenario for the average trader? Probably not. It’s a particularly high-risk high-reward play and only for those who understand and can accept the high stakes involved. A large measure of patience and discipline will be needed to handle this long-term campaign, which could take as long as two years to work out.

3. 这个设想适合一般交易者使用吗?也许不适合。这是个高风险高报酬的游戏,适合那些明白这是豪赌,也愿意接受它的人来玩。这场长期作战,可能要花上两年的时间,所以需要有很大的耐心和纪律。

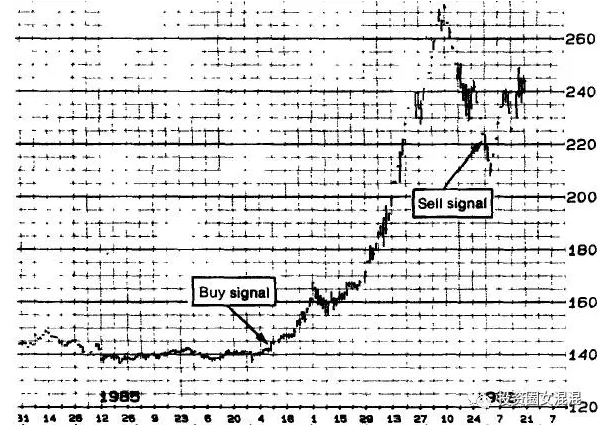

In case this strategic scenario sounds a little too complex or difficult for you to engineer, is there some other way to score megaprofits? Consider the experience of some 400 commodity traders scattered throughout the world. The computerized printout from their long-term trading system, which I monitor daily, flashed a buy signal on coffee, October 10, 1985, at a price of 139.93 (basis the perpetual price, equivalent to a 91-day future). What was so remarkable about that? Nothing yet. The system remained long about 16 weeks, till January 29, 1986, when it put out a sell signal. The price? 223.34. And, if you have to ask what was so remarkable about that, you ought to brush up on your elementary arithmetic. The difference between 139.93 and 223.34 is 83.41 cents, and at $375 per cent, the move amounted to “just” over $31,000 per contract (see Figure 19-3). Here was a mega-move, without any doubt!

未免这个设想对你来说太复杂,也太困难,那么还有没有其它可以赚大钱的方法?我们拿散布在全球各地约四百位商品交易者的经验来说明。我每天都会监视他们所用长期交易系统打印出的报表,发现1985年10月10日发出了咖啡豆的买入信号,买入价格是139.93(依据连续价格,相当于91天的期货)。这件事有什么了不起?到这里为止看不出有什么了不起的地方。他们的系统一直还是看多,直到1986年1月29日才发出卖出信号。卖价是多少?223.34。如果你要问这其中有什么了不起的地方,那你该把小学算术搬出来才行。139.93和223.34的差价是83.41分,这次行情合计每份合约利润可以达到31000元(见图19-3)。毫无疑问,这是个超级利润!

图19-3 1986年5月咖啡豆

【Over 400 system traders throughout the world got a buy signal at 139.93 on October 10, 1985, and a subsequent sell signal at 223.34 on January 29, 1986 (prices basis 91-day perpetual). The profit on the trade was 83.41 cents, equal to over $31,000 per contract. These occasional megaprofits more than cover the losses posted by long-term position systems when they are whipsawed by broad, sideways markets.

全世界400多系统交易者在1985年10月10日139.93等到买入的信号,然后在1986年1月29日的223.34得到卖出信号(连续91天价格)。这次交易的利润是83.41分,相当于每份合约超过31000元。这种偶尔一见的超级利润,足可弥补长线仓位系统在宽广的横向盘整中被洗盘发生的亏损,利润还会多很多。】

It’s obvious that this was not your normal, everyday trading profit. However, some successful long-term technical traders and trading systems out there are able to score a number of big profits annually-and I define a big profit as anything around or over $5,000 per contract. Moreover, lots of other traders do manage to get aboard these markets somewhere near the inception of the move. Regrettably, though, they don’t also manage to remain aboard for the duration or even a major portion of it. Anyone who has been trading for at least a few years will surely recall positions he had that, if held for the extent of the move, would have resulted in a megaprofit. The key phrase here is, “if held for the extent of the move,” because it rarely is. I reinvite your attention to the Livermore quote in Chapter 16, paraphrased in part here: “You always find lots of early bulls in bull markets and lots of early bears in bear markets…They made no real money out of it…Men who can both be right and sit tight are uncommon.”

很明显的,这不是你平时或者每天的交易能够赚到的利润。但是有些成功的长期技术交易者和交易系统,一年结算下来,能够赚到很多的大钱——我所说的大钱,是指每份合约利润5000元左右或者更多。其他很多交易者能够在大行情发动之初就搭上车,但是很遗憾,他们没办法在行情继续原来的趋势时,能够做到继续待在车上。任何人只要交易过几年,心里会明白,如果能继续持有原来的仓位更长时间,就能赚大钱。这里的关键句子在于“如果能继续持有原来的仓位更长时间”,因为能够做到这一点的人很少。讲到这,我要请你再回过头去看看第16章利弗莫尔所说的话,这里我们只摘录一部分:“你总是可以看到大多市场里有很多人早就做多,空头市场里有很多人早就做空……但是他们没有赚到钱……能够做对事情又能抱牢不放的人才是高手。”

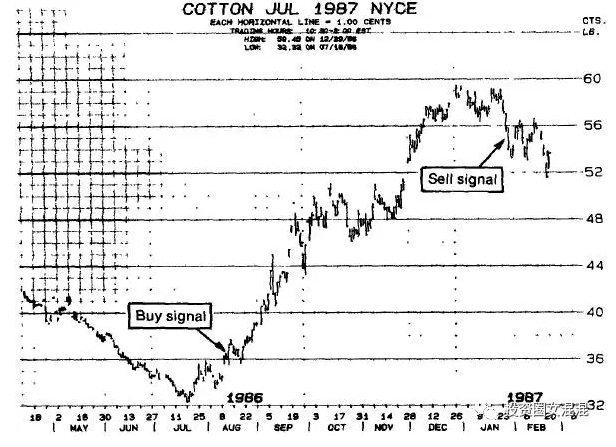

We obviously have no way of knowing, when we put on a position, if it will turn into the big one. Therefore, so long as we are trading in the direction of the major trend, we should premise that every position has the potential to be the megamove and play the market accordingly. And that means holding the position (“sitting tight,” as Livermore would say) until your stop, which you advance with the market, takes you out. One of the best examples of a totally unexpected megamove was in cotton. On August 13, 1986, traders in some of the long-term trading systems got what appeared to be a routine buy signal in cotton, at 34.54 (prices basis perpetual price). The signal appeared a little dubious, especially because the market had been locked into a huge bear trend from the 68.00 level with cotton traders having spilled lots of red ink while bottom-probing during past months. In fact, many experienced cotton traders were weary from successive losses on antitrend long positions and opted to sit this one out. Meanwhile, most of the neophytes, believing the admonition in their systems manuals to “take all signals,” followed the signal and bought the cotton.

我们在建立仓位的时候,显然没办法知道自己会不会赚大钱。因此,只要我们顺着主趋势的方向交易,我们都应假设每一个仓位都有潜力赚大钱,因此应该用这种心态去交易。这表示,仓位都要持有(用利弗莫尔的话来说,是坐得住)到止损出场为止。止损点要随着市场的趋势不断移动,直到它把你带出场为止。有一个很好的例子,是在完全出乎意料的情况下出现的大行情趋势。这个例子是棉花。1986年8月13日有些利用长期交易系统的交易者,在34.54(连续基期价格)得到似乎是一般性的棉花买入信号。这个信号看似有点可疑,特别是因为价格从68.00开始下跌以来,就锁住在很强的空头趋势中,过去几个月,棉花交易者为了探测底部,亏损了很多钱。事实上,很多有经验的棉花交易者,对于自己逆势建立多头仓亏损累累已感到厌烦。但是这个时候,大部分新手遵照系统手册上指导:“所有的信号一律遵守”,依信号买入棉花。

I don’t think that anyone was more amazed than I was at what actually happened. On the afternoon of January 28, 1987, some 5.5 months after the buy position was signaled, I received a near-cryptic phone call from a pharmacist in Rapid City, South Dakota. He and I had corresponded on occasion, and, if there ever was a rank beginner in futures trading, he was it. Anyway, he was so excited he could barely talk – but the gist of what I understood, after I managed to get him to communicate in normal English, was that his system just that morning had flashed a signal, at 54.83, to sell the cotton position. He had dumped the position and was totally undone at the realization that he had just scored over $20,000 profit on his two contracts. After further conversation, I was also undone when I learned that he had been unaware until that very day of the magnitude of his profit-which may have been the reason he sat with it for the full term of the move (see Figure 19-4).

我敢说没有人比我对实际上发生的事情更为惊讶。1987年1月28日下午,也就是在买入信号发出后5个半月,我接到南达科塔州拉皮德城一位制药业者打来的一通近乎神秘的电话。他跟我偶尔通信,算是期货交易中一位新手。闲话不说,当时他兴奋的几乎说不出话来——但是在我设法要他平缓下来,用清楚的语句说话之后,终于知道他要讲的是什么。他说,那天早上他的系统刚发出信号,要他在54.83卖出棉花仓位。他把仓位平得一干二净,发现自己的两份合约赚了20000元以上。进一步交谈之后,我才知道他也是到那一天才知道自己赚了那么多的钱——这可能是他无意中在整个行情进行期间继续持有的原因(见图19-4)。

图19-4 1987年7月棉花

【Following a virtually uninterrupted downtrend from the 68.00 level, system traders received their long-awaited buy signal on August 13, 1986. The long position was held for 5.5 months and was liquidated on a sell signal on January 28, 1987. The profit was some $10,000 per contract. Here is another example of a megaprofit generated by a position trading system in a dynamically trending market. But the same system that produced this profit produces a succession of losses during broad sideways markets.

从68.00起几乎马不停蹄地下跌之后,系统交易者在1986年8月13日得到等候已久的买入信号。这个多头仓可以持有5个半月,然后在1987年1月28日依卖出信号平仓,每份合约利润约10000元。这是趋势强劲的趋势市场中,仓位交易系统创造超级利润的另一个例子。但是同样的系统,在上下起伏颇大的横向盘整中,却频频让交易者发生亏损。】

No doubt about it, this gentleman from South Dakota experienced the Thrill of Catching the Big Move for the Megaprofit. And you can too, once you begin operating with a consistent discipline to trade the moving markets in the direction of the major trend, to stick with the position till your (advancing) stop takes you out, and to resist excessive positioning or overtrading due to boredom, tips, or market gossip.

毫无疑问,南达科塔州这位老兄体验到了逮住大行情赚大钱的激动。一旦你开始前后一致的纪律,往主趋势的方向交易,并持有仓位直到止损点把你带出场为止,而且这期间不要建立过大的仓位,或者因为趋势令人无聊,或者根据市场上的小道消息而频繁进出,你也有机会逮住大行情赚到大钱,享受那难得一见的激动。

每日精彩,欢迎扫描二维码关注期乐会微信公众平台。

感谢作者辛苦创作,部分文章若涉及版权问题,敬请联系我们。

纠错、投稿、商务合作等请联系邮箱:287472878@qq.com