第十四章 善用周而复始的季节性波动

Taking Advantage of Recurring Seasonal Tendencies

Although it was William Shakespeare who said, “Beware the Ides of March,” it was S. Kroll who said, “I’m not so concerned about March (besides, it’s my birthday). It’s February that’s giving me fits!”

威廉·莎士比亚说过:“当心3月份”,克罗却表示:“我没那么担心3月份(虽然我的生日就在3月)。让我不安的是2月。”

As we arrive at the month of March each year, I breathe a sigh of relief. That’s because January and February are consistently the most vexing months for the trend-following commodity trader. Market action is extra volatile, and price fluctuations seemingly random.

每年到了3月,我总会松一口气。这是因为对顺势交易的交易者来说,1月和2月常常是最忙碌的月份。不但市场的波动特别激烈,连价格也似乎毫无道理的乱窜。

February, in particular, coincides with what I call the February break. This is the period when even well-entrenched bull markets take a reactionary respite and ongoing bear trends seem to accelerate their decline. The February break had its roots in the grain trade, where producers would tend to hold each year’s crops off the market till the beginning of the following year. This strategy gave them two benefits: They deferred their tax liability on the crop, and their first-quarter sales provided money for April 15 tax payments plus funds for general farm purposes. And although agricultural markets constitute a much smaller percentage of futures trading today than in former years, this entrenched tradition of the February break still exists. And it continues to be a significant market factor.

尤其是2月份,恰好跟我所说的2月小憩碰到一起。这段期间内,明确的多头市场会回调休息,持续进行的空头趋势则会加快下跌。2月小憩的根源在于谷物交易,因为生产商往往会保留每年的收成不上市,直到下一年开始再说。这个策略可以给他们带来两个好处:作物的应缴税额可以延缓,第一季的销售收入则够用在4月15日缴税,无形中多的钱可以做其它事。虽然农产品市场占期货交易的比率已不如往年,这个行之久远传统的2月农休仍然流传下来,而且仍然是个重要的市场因素。

Is there a way that the technical trader can take advantage of this phenomenon? You bet there is! First of all, be a bit wary of new long positions, especially in the agriculturals, during this period. If I got a buy signal, I would take the trade but not with the same degree of confidence (take a smaller position than usual) as for a short position on a sell signal.

交易者有办法从这个现象中谋取利润吗?我敢跟你说有!首先,在这段期间内,建立新的多头仓时,要非常小心,尤其是在农产品市场中。如果我看见买入信号,我还是会去交易,只不过信心没有看见做空信号时那么强,所以说多头仓的规模要小。

However, there is another intriguing aspect of this February break that can significantly benefit both the hedger and the long-term trader. Starting in early March, keep a close watch on your daily charts and draw a red horizontal line at the level of the January-February closing high. This provides you with a particularly efficient buy stop to either take on a new long position or to cover shorts and flip to long. This level is likely to be a formidable resistance point, which should be difficult for many markets to overcome (see Figures 14-1 and 14-2). The rationale to buy on stop above this level is that you want to be long whichever markets have sufficient strength to surpass, on a closing basis, their January/February high close. Further, a strong weekly close would be even more significant than a daily close. Not all markets will be able to surpass this level, and these should probably be played short, or not at all. Notwithstanding this rather simplistic trading strategy, all positions should still be protected with reasonable stops at your personal pain threshold, whether it’s a specific dollar figure or a percentage of the margin requirement.

但是2月小憩另有一个很有趣的层面,不管是避险者还是长线交易者都可因而大大受益。3月初开始,你要密切注意你的日线图,在1月——2月的收盘价的最高点画一条水平红线。这条线是个很管用的买入止损点。不管你要建立新的多头仓,还是平仓改做空。这个价位很可能是非常难以克服的阻力点,很多市场都难以越雷池一步(见图14-1和14-2)。市场应该有足够的强势,也就是收盘价超越1月——2月的收盘高价,你才会在这个止损点以上买入。而且,周收盘价显露的强势比日收盘价显露的强势更重要。并不是所有的市场都有能力穿越这个价位,因此逼迫到这个价位时,都应该做空,要不然就是缩手在场外观望。但是即使有这么个简单的交易策略,所有的仓位仍然都应该用合理的止损点来保护。这个合理的止损点,我们在上章说过,是你的痛苦门槛,你可以根据个人能够忍受多少金额的损失来设定,也可以按需缴保证金的一定比率来设定。

图14-1 1987年7月糖 (文字:1月/2月高价)

【Sugar’s strong uptrend stalled at the level of its January/February highs. A line across these highs, at 8.60, provides an efficient buy stop, on a closing basis, to either go long, or to add to previously held long positions. Short players can sell against this level, using the closing penetration of 8.60 as a reversal stop.

糖市强劲上涨趋势在1月/2月的高价处受阻。沿着这个8.60的高价画一条横线,是很管用的买入止损点,以收盘价为准,不管是做多还是多头仓加仓。做空的交易者可以在价格逼近这条线时卖出,并以收盘价突破8.60做为止损点。】

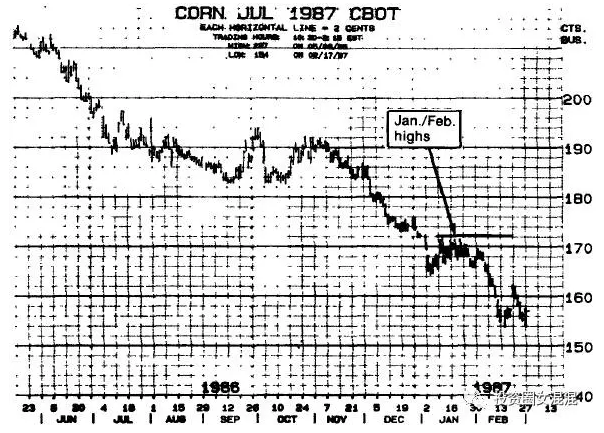

图14-2 1987年7月玉米 (文字:1月/2月高价)

【A classic bear market. The reaction was clearly accelerated during the January/February period. A line drawn across the January/February highs at 1.72 defines a significant zone of major resistance. You can add additional shorts against this resistance level, say around 1.66. The 1.72 top provides an efficient buy stop, on a closing basis, to cover shorts and flip to long.

典型的空头市场。1月/2月的回调速度很明显地加快。1月/2月的1.72高价所画的横线,是个压力很大的阻力区。价格涨近这个阻力区时,你可以加仓做空,比如在1.66左右。1.72的头部是个很管用的买入止损点,但是以收盘价为准,如果是做空的,到了止损点时可以改做多。】

The February break is just one of the seasonal price tendencies that affects futures prices on a recurring basis. However, each futures market has seasonal characteristics particular to its own set of supply and demand factors. If you understand these, you’ll be a better trader.

2月小憩只是周而复始影响期货价格的季节性价格波动倾向之一。每一个市场都有它独特的季节性特性,尤其是跟它本身的供需有关。如果你懂得这些,你的交易成绩会更好。

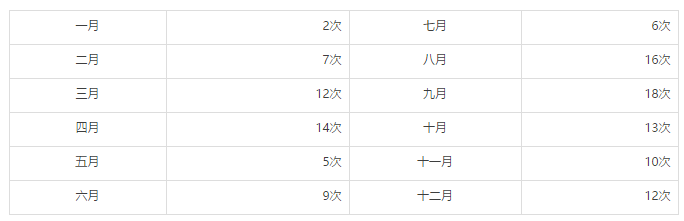

It was W. D. Gann, one of the giants of futures speculation, who first underscored the importance of seasonality in futures analysis. His classic work, How to Make Profits Trading Commodities (How to Make Profits Trading Commodities (Lambert-Gann Publishing Inc., 1942, revised 1951).), devotes considerable attention to the concept of seasonality as a powerful tool in price analysis. As an example, Gann identified the seasonal trends for wheat for the period from 1841 to 1941. According to his analysis, the market reached extreme month of the year, over the 101-year period.

期货投机大师之一的江恩首先在期货分析中强调季节因素的重要性。他的经典之作《如何从商品期货交易中获利》(美国1942年出版,1951年出修订版。中国2007年机械工业出版社出版。)以相当大的篇幅,探讨季节性的概念,认为这是价格分析过程中一个非常有力的工具。举例来说,江恩观察1841——1941年之间小麦的季节性趋势,根据他的分析,在这101年的期间内,价格走到极限的月份次数如下表所示:

Gann’s analysis noted that the month of August, just following the harvest, scored the most lows. He recommended that, when the market reaches lows in March or April, you buy for the rally because most tops come out in May. Then, if you do get the strength in May or early June, you should sell short, anticipating the seasonal trend to result in low levels in August.

江恩的分析指出8月,也就是收割以后,创低点的次数最多。他建议在3月或4月价格比较低的时候买入,因为市场会反弹,大部分头部会出现在5月。接着,如果5月或6月初真的见到市场显现强势,那你应该做空,等着季节性趋势把价格带到8月的低点。

Another acclaimed trader who did considerable research into seasonal tendencies was Ralph Ainsworth (Ralph M. Ainsworth, Profitable Grain Trading (Greenville, S.C.: Traders Press, 1933, reprinted 1980).). He published the Ainsworth Financial Service, one of the leading grain forecasting services of the 1930s. It was said that his basic timing system consisted of a number of proprietary Grain Trading Calendars (this one for wheat).

拉尔夫·安兹渥斯(《赚钱的谷物交易》,1933年出版,1980年重印。)也是在季节性趋势方面做过很多研究的有名交易者。他出版的《安兹渥斯财经服务》是1930年代很权威的谷物预测刊物。据说他的基本进出时机系统,是由很多个人独门秘方《谷物交易黄历》构成的(以下是小麦专用的历法)。

Feb 22 BUY WHEAT, following the bearish effect of the first Argentine crop run.

2月22日 在阿根廷第一次谷物暴跌,看空情绪弥漫之后,买入小麦。

Jul 1 BUY WHEAT, on likely price deterioration following a period of good crop prospects.

7月1日 在一段谷物看好的预期之后,因价格可能走软时买入小麦。

Nov 28 BUY WHEAT, before the news of crop damage from the Southern Hemisphere.

11月28日 在南半球收成受到伤害的消息发布之前买入小麦。

Jan 10 SELL WHEAT, because it is apt to have advanced too high and may be overbought.

1月10日 由于这个时候价格总是涨得太高,有超买之嫌,所以卖出小麦。

May 10 SELL WHEAT, as this should be the last of the winter kill scare.

5月10日 应该是最后一个冬害消息,所以卖出小麦。

Sep 10 SELL WHEAT, as this could follow the black rust scare.

9月10日 黑穗病引起恐慌,卖出小麦。

After reviewing these seasonal trading systems, one has the distinct feeling that we’ve come a long way since the empirical and subjective studies of the 1930s and 40s. However, it wasn’t until the availability of powerful computers and software that analysts were able to exploit, and go far beyond, the studies of Gann, Ainsworth, and others.

看过这些季节性交易系统之后,也许有人会觉得那不过是远在30年代和40年代的经验和主观研究。但是大家要知道,那个时候并没有强有力的电脑软件。此后分析师才有办法用电脑和各种各样的软件去探讨和超越江恩、安兹渥斯和其他人的研究。

The leading proponent of seasonal studies is Jake Bernstein, who has combined modern computer technology with an objective research approach. His, MBH Seasonal Futures Charts (MBH Seasonal Futures Charts (Winnetka: Ill.: MBH Commodity Advisors, published annually).), published annually, presents a computer study of weekly seasonal futures tendencies. This soft-cover volume focuses on some 25 futures from all the actively traded markets. Besides containing an excellent collection of seasonal charts, it also offers the most informative discussion of seasonal price analysis that I’ve ever seen. Bernstein first offered a seasonal chart study (1953-1977) of cash commodities in 1977, followed two years later by his Seasonal Chart Study of Commodity Spreads. Over the years, he has improved and expanded these guides with the assistance of powerful computer equipment (see Figures 14-3 and 14-4).

杰克·伯恩斯坦是季节性研究方面的著名专家,结合了现代的电脑科技和客观的研究方法。他的《MBH季节性期货图》,利用了电脑研究每周的季节性期货倾向。这本平装书包含了交易活跃市场的25种商品。除了有很棒的季节性图形之外,还有季节性价格分析文章,内容之丰富,我在其它地方不曾见过。伯恩斯坦首先在1977年出版了《季节性期货图研究》(1953年——1977年),两年后又出版了《季节性跨期期货图研究》。这些年来,他靠强有力的电脑设备,改进和扩充了这方面的内容,提供了更好的指导(见图14-3和14-4)。

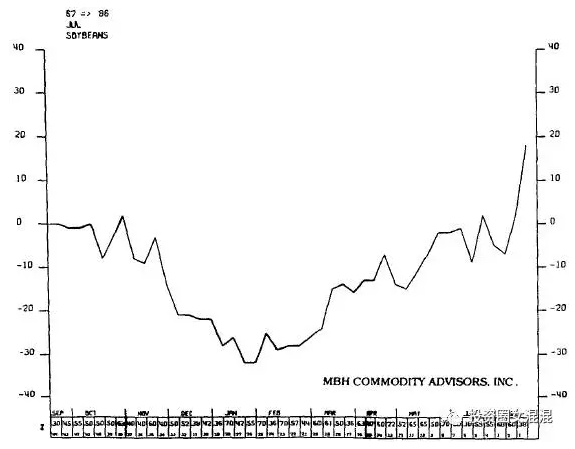

图14-3 7月黄豆季节性周线图 (文字:MBH商品顾问公司)

【There seems to be a strong seasonal uptrend from mid-February (coinciding with the February break) through the expiration of the July future. The contract tends to expire near the highs. Lows made late in the previous year are tested in January, and upside penetration of the January high often triggers the seasonal move.】

2月中旬(恰值2月小憩)到7月期货合约到期的这一段期间内,似乎有相当强劲的季节性上涨趋势。7月合约往往会在高点到期。前一年年底出现的低点,会在1月间受到确认,向上突破1月高点时,往往会引发季节性的波动。

图14-4 12月棉花季节性周线图 (文字:MBH商品顾问公司)

【The December future seems to show the best seasonality of all cotton futures From a seasonal low around April, the contract tends towards seasonal strength. Note that the up and down swings in cotton can be quite violent.

12月期货似乎是所有棉花期货中最具有季节性波动现象的期货,12月棉花期货在4月左右达到季节性低点,此后就展现季节性强势。大家可以看得出来,棉花的上下起伏相当激烈。】

The current version presents, in both chart and tabular form, the recurring seasonal tendencies for a broad range of futures, including the percentage of years when the price of each future, for each week in the year, was up or down. In his foreword to the collection, publisher Bernstein notes that there are regrettably too few traders who really understand how to derive maximum benefit from seasonal studies. Too frequently, the speculator will refer to a particular seasonal merely to help justify an existing market position, and if the study does not agree with his position, he will somehow rationalize the disparity and end up ignoring the seasonal.

目前的版本是用图表形式显示多种期货周而复始的季节性倾向,包括每一种期货每年,一年中每周上涨或下跌的比率。发行人伯恩斯坦在序言中指出,很遗憾的,真正懂得从季节性研究之中谋取最大利润的交易者少之又少。投机者谈到某个季节性波动现象时,常常只是为了替自己建立的仓位辩护。如果自己的仓位不合季节性的研究结果,他又会到处找理由来解释为什么会有这种不同的现象,最后则是把季节性因素抛到一边去。

From a strategic point of view, seasonal considerations stack up as an important device in the technical trader’s toolkit. It is not a standalone technique, nor can it be used as a substitute for a good system or other technical approach. But it can be used to confirm or reject, trading conclusions based on other techniques. I would not do long-term position trading without checking out the relevant seasonal studies, than I would fish for bluefish without consulting the fishing calendar. February is a poor month for bluefish!

从策略性的观点来说,季节性考量是技术交易者工具箱里面一个很重要的工具。它不是个孤立的技术,也不能用来替代良好的系统或其它技术方法。但是它可以用来确认或否认其它技术交易方法的结论。在没有检查相关的季节性研究资料之前,我绝不贸然交易长线的仓位,这就像我不会不先翻翻钓鱼资料,就兴冲冲跑去钓青鱼。2月份并不适合钓青鱼!

方向不对,努力白费!

《赢乐-通向财富自由之路》第五期即将开课啦!

(点击图片查看详情)

每日精彩,欢迎扫描二维码关注期乐会微信公众平台。

感谢作者辛苦创作,部分文章若涉及版权问题,敬请联系我们。

纠错、投稿、商务合作等请联系邮箱:287472878@qq.com