第十二章 每个人都有一套系统(2)

Everyone Has a System

These few studies were conducted during the 1970s and early 80s, and, clearly, a considerable amount of much more sophisticated research and testing has been done since that time. Nevertheless, these basic studies can help technically oriented operators as a starting point for the research and testing of more advanced and personalized trading systems.

以上提到的少数研究是在70年代和80年代初进行的。很显然,从那以后,有很多更为复杂的研究和测试。不过,上面所讲的方法仍可做为技术交易者做为研究和测试更进步和更有个性交易系统的起点。

A recurring thesis of mine is that a good technical method or trading system is only half of what is needed for overall successful operations. The other half-and of equal importance-is a viable strategy for applying the technical method or system. I would rather have a mediocre system coupled with an excellent strategy than an excellent system with mediocre strategy. The ideal solution, of course, would be a first-class system plus a first-class strategy.

我个人一再想到的问题是,良好的技术方法或交易系统,只是整个成功交易所需的一半而已。另一半——同样重要——是应用这些技术方法或系统的一套可行策略。我宁可有一套平凡无奇的系统,但一定要有一套优秀的策略,而不希望系统出色,策略却平凡无奇。当然,理想的解决方法,是一套一流的系统加上一流的策略。

Some time ago, I collaborated with a talented mathematician who had designed the parameters for an excellent computer-oriented trading system. During a lull in the technical aspects of our meeting, I asked for his thoughts on how a trader should approach a trading system in order to derive the maximum benefits from using it. Here was his list.

先前,我跟一位才华出众的数学家合作。他为一套绝佳的电脑交易系统设计了参数。我们见面谈到技术层面时,我问他,一个交易者应该用什么态度面对交易系统,才能得到最大的利润?他的看法如下:

He must have confidence in the system so he is not constantly trying to override, second-guess, or “improve” it on the basis of personal emotions, biases, or just plain wishful thinking.

他必须对自己的系统有信心,不能因为个人的情绪,偏见或一厢情愿的想法,而想去超越,猜测或“改进”它。

He must have the patience to wait on the sidelines for trading signals and then, once in a position, further patience to sit with it until a reversal signal is given.

他必须有耐心在场外等候交易信号,一旦建了仓位,要一样有耐心抱着不动,直到反转信号出现。

He must have the discipline to trade in accordance with both the signals and the trading strategy of his system.

他必须严守纪律,同时遵守交易系统的信号和自己的交易策略。

Over the years I have had lots of correspondence with traders; many are experienced operators who have experimented with a succession of systems. The comments come as close to a universal experience in the use of trading systems as I’ve ever seen. Some contain excellent advice.

这些年来,我跟不少交易者通过信;其中很多人都是有经验的交易者,试验过一连串的系统。就我的观察,以下列举的谈话,几乎是所有人使用交易系统共有的经验,其中还有一些很棒的建议。

From S. H. in Redwood City, California:

I am very pleased with the system I am now using. For me, it comfortably and satisfactorily gives me guidance, is providing very good results, and is answering my problems with stop management and related profits or lack thereof. Had I not been using the system, my profits would have been greatly reduced.

加州红木市的S.H:

我对现在所用的系统很满意。对我来说,它给了我舒服和满意的指引,提供了非常好的成果,在止损点管理,相关利润等问题上给了我答案。要是没用这套系统,我的利润一定大幅缩水。

From T. A. in Paris, France:

It unfortunately has taken me eight months to fully appreciate and accept everything the system comes up with. I’ve managed in spite of myself to make money, but I would have made considerably more had I not tried to find shortcuts within the system.

法国巴黎的T.A:

很不幸的,我花了8个月的时间,才能完全赞同和接受系统告诉我的每一件事情。我已经能够把自己撇开去赚钱,不过,要是我没在系统内找捷径,赚到的钱可能会更多。

To be fair, I also had a lot to learn in the basics of trading commodities. I also had to learn a lot about myself – lack of patience, lack of discipline, general stupidity at times, and a desire to feel that I was capable of independent thought and not just a blind follower of someone else’s system. What was amazing last year was that every time I went against the system, I lost. Not even the law of averages offered me a helping hand. I’m thankful that cotton and coffee made their magnificent moves to save me from myself.

老实讲,我在商品交易的基本知识方面,还有很多东西要学习。我也需要多了解自己——我没有耐心,缺乏纪律,有时愚不可及,误以为自己很能干,有独立思考的能力,不盲从别人的系统。去年,每当我违反系统时,我就会失败,这很神气。还好平均线法则帮我了,也要感谢棉花和咖啡豆市场的重大趋势,让我能自救。

Needless to say, in 1987, I will be following to the letter the buy and sell signals generated by the system. My tinkering to get an extra 5-10 points here and there has definitely not paid off. I've also come to the conclusion that I am as incapable as the next person of picking the tops and bottoms. Last year was excellent in one respect in that the pain of experience and suffering has burned in some very helpful lessons that I will not soon forget.

不用说,1987年的时候,我一定会亦步亦趋地依照系统发出的买卖信号去做。我自己穷忙,要在这里赚5点,那边赚10点,根本没占到便宜。我已经明白,我和坐在旁边的一直想找头部和底部的老兄一样无能。去年惨痛的经验给了我一些很有用的教训,绝不会马上忘记,所以说去年是收获丰硕的一年。

From M. L. in Austin, Texas:

I thought you might be interested in my three years of actual operating experience with the XYZ System. I purchased the system in May of 1983 and paper traded part of that year, since I found that I would, all too frequently, try to second-guess the system either by taking some trades and not others or by trying to anticipate trades. Quite honestly, little by little, I came to use the system the way it was intended, taking and then following the trading signals consistently and confidently.

德州奥斯汀的M.L:

我想,你肯定想了解我过去3年使用XYZ系统的情况。我是在1983年5月买的,但是没有马上照它所说的去做。我自己不放心,常常不信任那套系统,反其道而行,自己预测。说实在的,慢慢地,我开始听系统的了,最后则是持之以恒和满怀信心地去用它。

The summation is that I started with $19,000 in my account and after three years I stood at $81,814. All this, in a consistent and reasonable progression, taking moderate risks and low drawdown.

整个算下来,我原来的账户里面有19000元,3年后则有了81814元。这些钱都是持续合理地赚到了,风险比例很小。

As an extra bonus, the system teaches patience, consistency, diversification, and discipline.And, although the human emotions of greed and fear, which cause most speculators to accept small profits and large losses, are still part of the trader’s universe, the system overcomes these impediments to profitable trading by helping the trader control these hangups and focus his trading into a disciplined and strategically viable speculation.

另外,额外的收获是,这套系统传授了耐心,前后一致,变化和纪律。人性的贪婪和恐惧会导致大部分投机者赚钱时赚的是小钱,亏钱时亏的是大钱,这是部分交易者的通病。幸好系统帮助交易者控制这些毛病,把注意力放在纪律性策略性可行的投机方法上,并实现利润。

So what is the bottom line – that a computerized trading system is the best way to go? My answer is a resounding definitely… maybe. First of all, how good is the system? In my discussion of trading systems, I invariably qualify the subject with the adjectives, good, sound, and viable. But what is good, sound, and viable? And, even if you can specify and define them, how can you determine if a given system is good, sound, and viable? Perhaps the ultimate test would be a free, no-obligation trial period (and it’s not likely that any system would be offered this way). But even that has its shortcomings. Results over any brief period may not be representative of its long-term capabilities. The best test would be to examine real-time trading results from traders who have actually been using the system for a period of at least two years – and you want to talk to as many different people as possible. Secondly, even if it is a successful system, you want to be sure that it is consistent with your trading approach and objectives. I have seen a trader spend substantial dollars on an excellent and proven system only to find it inconsistent with his trading approach (a long-term position system with a short-term trader). The system, regrettably, ended up on the shelf. In short, every system has its own personality and rationale, generally mirroring the personality and investment rationale of its developer, and though it may be a fine and viable system, it may not be the right one for you.

讲了这么多,到底我葫芦里要卖什么药?电脑交易系统是最好的方法吗?我的答案……可能是吧。首先,我们要谈谈系统有多好?我在谈到交易系统时,总会以一些形容词,像是良好,不错,可行来说明这个东西。但是什么叫做良好,不错,可行?即使你能够明白地定义它们,那你又如何决定某个系统良好,不错,可行?也许最好的检定办法就是来个没有约束力的测试期(任何系统都不可能按这种方式提供给我们)。但是就算这样做了,还是有缺点。短时间所得到的结果,可能不具有长期的代表性。因此,最好的检定办法,是要求使用系统至少两年的交易者提出他们实际应用所得到的成果——而且你必须跟越多的人谈越好。其次,即使那是个成功的系统,你还是得确定它跟你的交易方法和目标吻合才行。我见过一位交易者花了相当大笔的金钱在一套十分出色,并且证明可行的系统上,结果发现它跟自己的交易方法不合(他是个短线交易者,系统却是长期仓位交易系统)。很遗憾的,买来的那套系统只好束之高阁。简而言之,每一套系统都有它的性格和设计原理,通常反映了开发那套系统的人的性格和设计原理,虽然它可能是不错的系统但对你也许不适用。

In considering a system, you must determine if it actually performs as the seller or the advertising literature claims. It often does not, to everyone’s surprise. Some years ago, I met a trader from Seattle who was promoting a system that he had developed. He had excellent credentials and was associated veith a reputable firm, so I decided to look into it further and was promised full cooperation. I asked for some real-time trading results and was shown trading records from the developer’s own account, which were profitable and which tended to verify the system's claims. I was put off, however, in that they didn’t show me real-time results with any other accounts. If it was such a good system, wouldn’t other clients of the firm have come aboard? The next step in my due diligence inquiry was to monitor the signals daily, and I asked the developer to phone me with all signals as they were processed from the computer. Six weeks later, I decided that I had seen enough and dropped the inquiry. What put me off was not that nearly every trade during the entire six-week period was closed at a loss – that could be due to hitting a sideways nontrending market period. I was disturbed by something quite different. The system had been promoted as a long-term position approach, and, indeed, the historical paper trading record supported this claim. Regrettably, however, the signals phoned to me as they came forth from the computer seemed to have come from an altogether different system. Here is what I found:

考虑选用某个系统时,你必须决定它是不是像卖方或广告所说的那样管用。让我们惊讶的是,实际情况往往并非如此。几年前,我跟西雅图一位交易者碰面,他向我推荐他开发的一套系统。这个人信用卓著,而且在某家名声不错的公司工作,所以我决定好好看看那套系统,并保证全力合作。我请他给我看真实的交易纪录,那位交易者拿出他自己账户的交易纪录给我看。帐面上有利润,而这应该可以证明系统管用。但是我还是暂缓做决定,因为他并没有给我看其他账户的交易纪录。如果真的是那么好的系统,为什么该公司的其他客户没有抢着用?我这个人一向喜欢打破沙锅问到底,接下来就是要看它每天发出的信号,我告诉他,只要电脑交易系统发出信号,一律打电话告诉我。6个星期后,我确定我已经看够了,不再向他询问。我之所以这么决定,倒不是这6个星期内系统指示的交易都以亏损结束——那可能是因为没有趋势的横向盘整造成的,而是被一些相当不同的东西弄得我不放心。当初推销这套系统时,他说是长线交易系统,事实上,帐面上的历史交易纪录的确证明这一点,但是很遗憾的,电脑一有信号,并通过电话打给我时,听在我耳里,却好象那些信号是发自其它不同的系统。以下是我发现到一些有问题的地方:

Paper trading showed 83 percent of all trades profitable; real-time trading showed just 12 percent of all trades profitable.

帐面上的交易纪录显示84%的交易有利润,实际交易却只有12%利润。

Paper trading showed an average holding period of 34 days; real-time trading showed an average holding period of 5 days.

帐面上的交易纪录显示平均持有期间是3,4个月,实际交易中平均持有期间是5天。

Paper trading showed an average profit of $2,884; real-time trading showed an average profit of $440.

帐面上的交易纪录显示平均利润是2884元,实际交易的结果却只有440元的平均利润。

Needless to say, I have neither seen nor heard of this system since.

不用说,从此以后我再也没看过或听过这套系统。

Another aspect of a computerized trading system that concerns traders is its cost, which can run anywhere from $75 to $7,500. In fact, the initial cost of a system may be the least relevant factor in the trader’s decision. The most expensive system may turn out to be the most economical (This reasoning doesn’t just apply to trading systems. The most economical automobile I ever owned was a three-year-old Rolls I bought from a New York dealer for $24,500. After four years of enjoyable use, I sold it for $25,000.). In selecting a trading system, price should be less relevant than performance (no-consistent performance), reasonable drawdown, a favorable ratio between dollar profits and losses (a minimum of 3 to 1), and a compatible investment rationale.

交易者所关心电脑交易系统的另一个问题是价钱。便宜的系统只要75元,贵的要7500元。事实上,一套系统的初始成本,可能是交易者做决定时最不需要计较的因素。最昂贵的系统,最后反倒有可能是最经济的(这个道理不仅仅适用于交易系统。我买的最经济的车是一辆3年车龄的劳斯莱斯,从纽约的一个车商手上用24500元买的。享受了4年,然后用25000元的价格卖了。)。选购交易系统时,不要考虑价格,重点考虑性能(应该说是稳定,前后如一的性能)、合理的止损和低风险收益比(至少是1︰3),还要符合你的投资理论。

I am skeptical of the so-called black box type of system, where trading signals pop out of a computer without the system providing some logical rationale or glimpse of the charts and relevant “lines” underlying the analysis. The trader ought to understand what his system is doing, why the signals say what they do, and what the lines look like. Naturally the precise formulation of the system will not be disclosed. Some of the better systems even provide color graphics in their chart presentations and allow the trader the option of printing out the calculations, the worksheet, and the charts. Being able to get the charts onto hard copy is a significant advantage; it permits further study of the analysis and enables the trader to superimpose any of his other lines or studies on the same chart.

我对于所谓的黑箱式系统表示怀疑:这种系统使用时,交易信号会直接从电脑里面蹦出来,不告诉我们理论依据如何,不让我们看看相关的图形,以及所做的分析到底用了哪些相关的数据。交易者应该知道系统正在做些什么事,发出的信号为什么说该那样做,以及线路长的是什么样子。当然了,系统程序到底是怎么遍写的,可以不让我们知道。有些比较好的系统,会提供彩色图表,并让交易者决定要不要打印出计算结果,工作底稿和图形。能够把图形储存在硬盘上更能给人方便,因为将来还可以进一步分析,而且交易者可以把其它线路或研究成果画在同一个图形上。

The next logical questions to address are: What does a trading system consist of, how do you operate it, and what is the end product of the system? Excluding those few basic numerical systems that don’t use a calculator or a computer, a trading system consists of two parts – hardware and software. For hardware, you use either a programmable calculator (such as a powerful Hewlett Packard) or one of the microcomputers. You need some method of inputting daily price data, and that can either be done manually or by connecting into a remote data bank such as Commodity Systems Inc.’s QUICKTRIEVE (Commodity Systems Inc., 200 W. Palmetto Pk. Road, Boca Raton, FL 33432) To complete this connection you need a phone modem (and a plug-in wall module). Normally, you need two disk drives (or a hard-disk model) and a minimum of 256K memory. In terms of software, if you are using a programmable calculator, you need some way to “instruct” the calculator as to the computations, and this can be done in the form of small modules that fit into an access slot in the calculator. Most of the systems, however, run on a micro, and you generally use two disks, a program disk (that instructs the micro as to procedure) and a data disk. The data disk is updated daily, either through manual input or connection with a data bank via phone modem. Data update consists of either actual prices or perpetual prices. Perpetuals are a continuous series of prices that are calculated by the data bank (the 91-day perpetual is a popular form) and that tend to smooth some of the gaps and imbalances in actual price data. There are many advantages to using perpetual data. One is that it eliminates the need to reenter and recalculate your price data every time a futures month expires. Perpetual data is just that-perpetual and continuous.

下一个要讨论的问题自然是:交易系统有哪些东西组成?你要怎么交易?系统最后吐出来的东西是什么?我们不讨论那些不用计算器或电脑的少数数字系统,一个交易系统包含两部分——硬件和软件。硬件方面,你可以用可编程的计算器(如惠普公司功能强大的产品)或者一台电脑。你必须用某种方法把每天的价格资料输入,可以用手输入,或者跟远距的数据库连线,如商品系统公司的QUICKTRIEVE。要连线,必须有调制解调器和电话线接头。正常情况下,你需要两个磁盘驱动器(或者一个硬盘,内存容量至少256 K)。软件方面,如果是计算器,那你需要用某种方法指示计算器怎么运算。但是大部分的系统都是在电脑上面跑的,通常需要两张磁盘,一张程序磁盘(把程序告诉电脑),以及一张资料磁盘。资料磁盘每天更新,方法或者用手输入,或者是通过电话调制解调器跟数据库连线。更新的资料可能是实际的价格,也可能是连续价格。所谓连续价格,是指数据库计算出来的一连串价格(连续91天数字是最常见的形式),有平滑实际价格发生缺口或失衡的作用。利用连续资料有很多好处,其中之一是某个期货月份到期时,你不必每次都要重新输入或重新计算价格资料。所谓连续,顾名思义,就是持续不断的意思。

The procedure starts by inputting the day’s prices; updating occurs each evening following the day’s close. If you don’t do it manually, you will have a separate software program for this; the process takes a few minutes at most. Once the price data has been input into your computer, and then transferred from your computer onto your data disk, you remove the data acquisition disk from your computer and boot up your program disk. Depending on the speed of your hardware and complexity of your program, running the program can take anywhere from 15 to 40 minutes. During this interval, the computer is calculating the stops and other signals based on the formulas on the program disk and the prices on the data disk. Then a near-magical thing happens-your printer comes to life and out of it emerges a printout containing the various prices and signals.

整个程序从输入每天的价格开始,每天收盘后,就要更新资料。如果你不想用手输入,那你需要一个软件程序来做这件事;整个程序顶多只要几分钟。一旦价格资料输入电脑,并由电脑存入资料磁盘后,就把存储资料的磁盘移出电脑,启动程序磁盘。依所用硬件速度和程序的复杂性,整个程序可能要跑15——40分钟。这期间内,电脑依据程序磁盘的公式以及资料磁盘的价格,计算止损点和其它的信号。然后,一件几乎像是魔术的事情发生了——你的打印机像是活了过来,打出有各种价格和信号的报表。

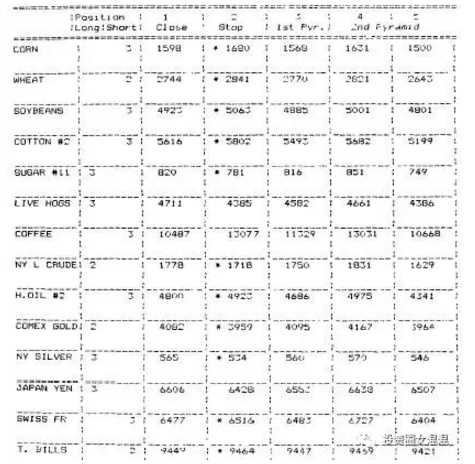

Some years ago, I was demonstrating a computer system to a colleague, and my young son, then aged 8, quietly observed the discussion. He was interested in the proceedings because he occasionally ran the system for me. At a lull in the conversation, apparently unable to restrain himself further, Charlie blurted out to my guest, “And he cheats-he gets the right answers out of the printer.” Well, I wouldn’t exactly describe what emerges from the printer as “the right answers,” although we always hope they will be. Printouts come in all sizes and formats, but typically look something like Figure 12-1. This particular system runs on either an Apple, an IBM, or one of the compatibles, and follows 16 markets. Each evening, it provides a printout containing the recommended position long or short, plus how many units (from one to three, depending on the strength of the trend). It then provides the market close for the day under review (in Figure 12-1, all prices are basis 91-day perpetual), the point for the reversal stop, and three other columns dealing with putting on or liquidating pyramid positions. Operators who play just a single contract or who are not concerned with pyramiding are not necessarily concerned with the final three columns in this particular system.

几年前,我正在向同事展示一套电脑交易系统,我的儿子那时8岁,在旁边静静地听我们讲话。他对我们所说的事情很感兴趣,因为有时候他会帮我运行系统。我们谈话间歇的一段时间内,小查理赫然再也按捺不住,冲口对来客说:“他骗你——他是从打印机里面找到正确的答案”。喔,我不指望打印机打出来的东西就是“正确的答案”,但我们希望那就是正确的答案。印出的报表有各种各样的大小和格式,但通常如图12-1所示。我们所说的这个系统可以在苹果电脑或者国际商业机器公司(IBM)及它们的相容电脑上面使用,跟踪16个市场。每个晚上,它会打出报表,里面会提到它建议做多头仓还是空头仓,提供收盘价(图12-1中,价格都是91天连续价),反转的止损点,最后三栏则告诉你要如何金字塔加仓和减仓。只做一个合约的交易者,或者是不关心金字塔加仓的交易者可以不用看最后三栏。

图12-1 某个长期交易系统每天打印出的报表(1983年5月的资料)

【This particular system runs on either an Apple, IBM, or one of the compatibles, and utilizes perpetual in its calculations.

这个系统可以在苹果、IBM或它们的相兼容的电脑上面使用,计算时则用连续价格资料。】

As you can readily see, a system is quite specific and exact, although there are a few systems whose analysis is subjective and dependent on the operator’s interpretation. Another significant feature of a good system is that it suffers no bias for the long side of every market, as do the majority of traders. All signals are derived from the mathematics within the program analyzing the prices of the last X days (anything from 6 to 72 days, depending on the particular system).

你可以马上看出来,系统会提供相当明确和精确的建议,但是有些系统的分析十分主观,而且要由交易者自己解释个中含义。良好系统的另一个重要特色,是它绝不会像绝大多数的交易者那样,老是只对任何市场的多头趋势有比较高的兴趣。所有的信号都是从程序内的数学运算,分析过去X天(6天到72天不等,视所用的系统而定)的价格得来的。

In the final analysis, it boils down to this: A trading system is a tool, and, like most tools, there are quality ones and mediocre ones. A system certainly isn’t the ultimate answer to consistent profits in the markets, and there are plenty of successful operators who wouldn’t know the difference between a data disk and a slipped disk. However, the right system can be a significant aid in your overall trading. But – and here comes the big “but” – its benefit will be proportional to the patience and discipline with which you approach and use it.

最后,我们的结论是:交易系统是个工具,而且就像大部分的工具,有好的工具,也有普通的工具。要在市场上经常获利,交易系统当然不是最后的解答,而且有很多成功的交易者根本不知道资料磁盘和一张破损的磁盘有什么不同。但是,选对了系统,对于你的整个交易会有很大的帮助。但是——这是一个大大的“但是”——它的效益跟你使用它时表现出来的耐心和有无纪律性成正比。

(点击图片查看详情)

每日精彩,欢迎扫描二维码关注期乐会微信公众平台。

感谢作者辛苦创作,部分文章若涉及版权问题,敬请联系我们。

纠错、投稿、商务合作等请联系邮箱:287472878@qq.com