第十一章 市场趋势总是已经消化吸收了消息

Market Action Invariably Discounts the News

Some years ago, I was collaborating with an economic analyst on a cocoa report. This was before I had reached the conclusion that cocoa was, from a long-term trader’s point of view, untradable, and that the appropriate way to deal with the stuff was to eat it, not trade it. Anyway, my colleague and I got onto the subject of news versus price action. He was nonplussed when I advanced the theory that more often the price makes the news, rather than vice versa. “Ridiculous,” he bellowed. “It’s common knowledge that the price reacts to the news, period.” I’m not generally a betting man, but I’m always willing to put some money down against the “common knowledge” theory of the universe. So the bet was duly made, with my thesis being that I could reasonably predict the news by watching the price and its interaction with the other technical factors in the market. It was the easiest $20 I ever made.

几年前,我跟一位经济分析师合写一份可可豆的报告。写完这份报告,我的总结是,从长期交易者的眼光来看,可可豆根本是不能交易的商品,处理这种东西的最好方式便是把它吃掉,不是去交易它。但是不管怎么样,这位同事和我还是必须去研究消息和价格趋势的关系。当我提出一个理论说,价格创造消息,而不是消息影响价格时,他显得很迷惑。“荒谬透顶,”他几近咆哮地说,“大家都知道价格会跟着消息走。其它不用说了。”大致来说,我不是个好赌成性的人,不过我倒愿意拿点钱来赌这个“大家都知道”的常识。刚好那时有个可以赌的对象,我提出的说法是,我可以根据价格趋势和它与其它市场技术因素的交互关系,合理地预测出会有什么样的消息出现。我打这个赌,拿出了20元,这是我赚的最轻松的钱

。

We were in the midst of a fairly strong bull trend, with the long side held largely by (weak) commission house specs and the short side primarily by trade firms and a few professional trading houses. (As you can guess, I had my own private theory as to who was going to win this one.) Following the first sharp break (the explanation for the big moves generally comes out after the fact), postulated that the forthcoming news would be either:

那时我们处于相当强劲的多头趋势中,做多的主要是经纪行的投机者,做空的主要是业内人士和一些专业贸易公司。(你可以猜得出来,我自己已有一套看法,知道谁会赢。)第一次大幅回调后(有关回调的解释,通常是在事实之后出现),我指出,将来一定会有下面两个消息之一出来:

1. One of the producing nations had suddenly “discovered” that they had more cocoa for export than they had previously (on the last rally, no doubt) announced.

1. 有个生产国突然“发现”能够出口的可可豆比早先宣布(当然这是上次大涨的成因)的要多。

2. A large quantity of cocoa bags would be unexpectedly “discovered” in a cocoa warehouse in Philadelphia or New York.

2. 费城或纽约某个可可豆仓库里意外发现数量庞大,一袋一袋的可可豆。

It turned out to be the “Philadelphia warehouse discovery” story this time around. Score one for the home team. Following a barrage of speculative long liquidation on resting stops, the market recommenced its upward course. Many of the former trade and professional shorts had covered and jumped over to the long side on the recent reaction. We then had a vicious weeklong rally, including two limit-bid sessions, during which the trade firms were back in there on the sell side. Towards the end of that week, I notified my partner that the rally would be attributed to either:

这一次的结果是“费城仓库里面发现了可可豆”,本人得一分,投机性多头大举平仓之后,市场又恢复上涨趋势。很多原来做空的人抢着平仓,并赶快在最近的回调处做多。接着我们见到长达一周猛烈的涨势,包括两个交易日涨停,贸易公司则趁这两天卖出。那一周快结束的时候,我通知合伙人,上涨的原因会是下列两者之一:

1. The sudden and unexpected outbreak of black pod disease in an African growing region.

1. 非洲某个种植地意外出现所谓的黑荚病。

2. The sudden discovery that the capsid bug had done foul things to stored cocoa in U. S. East Coast warehouses.

2. 美国东岸仓库里的可可豆突然遭到虫害。

It turned out to be the capsid bug story this time.

这一次是害虫惹祸。

The sugar market provides an excellent glimpse at the unique relationship between price and market news. The way news is released after every move should be studied by every thoughtful trader. During an extended bear market in sugar, culminating around the 2.50 cent level in mid-1985, the decline was accompanied by every type of bearish news imaginable. But after the market had reversed and started moving north, the bearish news items were put back in the desk drawer, and suddenly the bullish items were trotted out for dissemination. On January 26, 1987, following a 200-point sugar rally (equal to $2,240 per contract on a $600 margin), The Wall Street Journal noted the following:

要知道价格和市场消息间的特殊关系,糖市是绝佳的观察场所。每一个思虑周密的交易者,都应该好好研究一下每次价格波动之后消息发布的方式。到1985年年中跌到2.50左右的糖市长期跌势,整个过程都伴随着每一种能够想象出来的空头消息。但是在市场反转开始上升之后,利空消息都被人们塞到抽屉里面去了,突然之间利好消息满天飞。1987年1月26日,糖价涨升200点(相当于以600元保证金交易每份2240元的合约)之后,《华尔街日报》指出:

Reports that the Soviet Union had been a large buyer of refined sugar in the world market helped futures to extend their advance, with the March contract closing at 8.22, up 22 points. Analysts said Moscow bought 500,000 to 700,000 metric tons of raw sugar…and one analyst said the Soviets may buy as much as a million tons more. Analysts said prices also were buoyed by a report that Brazil will push back contracts to export 750,000 to 1.5 million tons of raw sugar to 1988 or 1989 and by reports that Cuba is having problems harvesting and milling its cane sugar crop. In Brazil, diversion of sugar to alcohol production, stronger domestic consumption, and indications that drought may reduce the crop have created tight supplies, analysts said.

有报导说苏联在全球市场大买精制糖,使得期货涨势欲罢不能,3月合约以8.22收盘,上涨22点。分析师说,莫斯科买了500000到700000吨的粗糖……有一位分析师甚至表示,苏联买入的数量高达100万吨以上。分析师说价格已经被报告抬高了,报告说巴西要把合约推后到1988或1989年出口750000吨到150万吨的粗糖,而且报告说古巴的收成和甘蔗加工出了问题。分析师还说,在巴西,制造酒精消耗了部分糖,国内需求旺盛,而且有迹象显示干旱可能会使收成减少,已经导致供给紧俏。

They seem to have “trotted out” every bullish item they could think of, but following the first 200-point decline, you can bet that the news will “suddenly” become totally bearish.

他们似乎能够“炫耀”每一个想象得到的利好消息,但是如果价格再下跌200点,我可以跟你打赌,消息“突然之间”会变得全部看空。

And so it goes. The salient points to keep firmly in mind are that market prices fluctuate and that, following every price move, analysts and commentators are in there offering perfectly plausible explanations for what just happened in the market. To many thoughtful observers, all this so-called news, pit gossip, and rumor seem rather conveniently contrived by some of the professional and trade operators to confuse, confound, and generally sucker as many gullible traders as possible into untenable market positions.

事实确实如此。我们心里必须要记住一件事情,那就是市场价格一定会波动,而且在每一次波动之后,分析师和评论家也一定会等在那里,对市场刚发生的事情提供完美的解释。对很多深思熟虑的观察家来说,所有这些所谓的消息,柜台前的闲聊以及传闻,都是一些专家和业内交易者企图捏造来迷乱、混淆、引诱容易受骗的交易者建立根本站不住脚的市场仓位,而且能够骗越多人就越好。

There ought to be a way to avoid being caught in this recurring trap – and there is. As simplistic as this may sound, the astute trader just ignores the plethora of rumor, pit gossip, and what generally passes for market news. He maintains his focus on the real technical factors underlying each market and on whatever disciplined strategy has worked best for him and his particular style. He never loses sight of the old Wall Street maxim, Those that know, don’t tell; those that tell, don’t know.

应该找个方法来避免掉入这样的陷阱——的确是有这样的方法。其实方法很简单:聪明的交易者只要不理会那些谣言、柜台前的闲聊和市场中到处流传的消息所引起的激情就可以了。他只要把注意力集聚在每一个市场中真实的技术因素,而且严守纪律,遵守一套对自己和自己独特风格最有用处的策略就可以了。他绝不会忘记华尔街的名言:知者不言,言者不知。

Late in 1984, I had an interesting telephone conversation with a trader in Houston. How, he asked, could we be experiencing a bear market in corn with this year’s crop roughly half the size of last year’s? Answering that question, I came to grips once again with the frequent disparity between the price action of a given market and the fundamentals – or perception of those fundamentals. In fact, as we observe time and again, price is the significant equalizer between supply and demand and is the key factor that brings out the news and gossip of what happened (note past tense) in the market.

1984年底,我跟休斯敦一位交易者在电话中有一段很有趣的谈话。他问我,今年的玉米收成约是去年的一半,怎么会有空头市场呢?回答这个问题时,我又提到某个市场的价格趋势往往会和基本面——或者说是我们对基本面所具有的看法——脱节的现象。事实上,我们一再看到价格是供需间重要的等式,同时价格的变化会引出相应的新闻和市场小道消息。

Back to the corn market. Sure, the recently harvested corn crop was considerably smaller than the trade and brokerage communities had projected at the beginning of the season, but the situation must be viewed in the context of price movements over the entire past year. In early 1983, corn was priced around 2.75 (nearest future) and, on the basis of the bullish fundamentals, rallied some 45 cents to 3.20 by April. Then, following a brief 20 cent bout of profit taking (just under a 50 percent reaction) the bull reasserted itself, with the market advancing to 3.75 by August. This $1 rally took just six months, and, least you be unimpressed with the move, it amounted to $5,000 per contract on a margin of just $700.

再回过头来谈玉米市场。当然,最近玉米的收成确实远比本季一开始业内人士和经纪商的估计要低,但是整个形式需要综合考虑过去一年价格的变化。1983年初,玉米价格约2.75(最近期),而且,在基本面利好的情况下,到4月价格上涨了约45分,到达3.20。接着,在获利回调卖压下,价格下跌约20分(不到50%的回调)后多头趋势再恢复,到8月涨到了3.75。这一元的涨幅,只花了6个月,如果你对这个数字没什么概念,那我们换个角度来说:这一元的涨幅意味着只需用700元的保证金,每份合约就能赚到5000元。

A bull market? Sure. But, in fact, the entire bull deal had already lasted a full year. By the time the price had reached the 3.75 level, the advance had discounted all the bullish news, and the trade and professional firms were then focusing on more sobering and less bullish factors, including a likely reduction in exports and the probability of a larger new crop. Well, was it still a bull market? Probably not! But it used to be one, before the price advanced, discounting the bullish factors. How was one to know?

这是多头市场?没错,但是事实上,整个多头趋势已经持续了一整年,到价格涨到3.75时,涨势已把所有的利好消息都消化在里面,业内人士和专业公司只好把注意力集中在并不重要的利好因素上,包括出口可能减少以及新作物的收成可能增加。那么,这还算是多头市场吗?可能不是!但是以前是,也就是在价格上涨,消化利好因素之前,算是多头市场。

Clearly, bullish and bearish market psychology exerts a major influence on traders’ decisions to buy or sell. Experienced operators know that the price functions as a barometer: It discounts the future. But that’s as far as it goes – you just can’t get it to discount the hereafter. Where does that leave the trader? He watches the market, keeps his charts, reads the financial columns, subscribes to services or advisory letters, and hears market opinions from his broker and friends. That’s a considerable volume of diverse information, and much of it is contrary and contradictory. So, how does the trader base his market decision on trend, support and resistance, price objective, stop-loss point, whether to pyramid, and so on? Lots of questions, with the bottom line being the single basic decision of buy, sell, or stand aside.

显然,看多和看空的市场心理,对于交易者的买卖决定有很大的影响力。有经验的交易者知道价格的波动是个气压计:它会把未来吸收消化在里面。但是等到趋势持续了一段时间,你再也没有办法继续吸收消化。那交易者该怎么办?他会注意观察市场,听听经纪人和朋友对市场的看法。于是各种各样的一大堆信息齐聚眼前,而且其中很多是相互矛盾,背道而驰的信息。这么一来,交易者怎么根据趋势、支撑和阻力、价格目标、止损点、是否采取金字塔加仓等信息来做进出决定呢?这里面牵扯到很多问题,而最根本的是:要买,要卖,还是出场观望?

I think the answer is obvious – it has been stated here in previous sections and will be restated. Market action (prices) invariably discounts the news, and you can’t be sure if the news is true or false. Even if it is true, has the market price already reacted to the news? And, further, even if you know the news to be true and know that the price hasn’t yet reacted to it, that still leaves a lot of questions unanswered: how to limit risks, where to put stops, whether or not to add to the position, etc. These all lead back to the same conclusion. For success in market trading, you must focus on two areas:

我认为答案非常明显——前面已经说过,以后也会再提。市场趋势(价格)总是预先吸收消化各种消息。而且你没办法确定消息是真是假。即使消息是真的,那么市场价格是不是已经对消息有所反应?再说,即使你知道消息是真的,而且知道价格没对消息有所反应,那么还是有很多问题没有得到解答:如何控制风险,如何设置止损,要不要加仓等等。这些全都回归到相同的结论。市场交易要成功,你必须把注意力放在两个领域:

1. A technical approach that has proven itself or possibly a long-term trading system – most likely run on a computer – you have confidence in.

1. 一套技术方法,它已经证明是一个适用的长期交易系统——能在电脑上运行——或者有可能成为这样的系统,而且你对它有信心。

2. Sound trading strategy and the utilize this strategy.

2. 优秀的交易策略,而且你能运用这套策略。

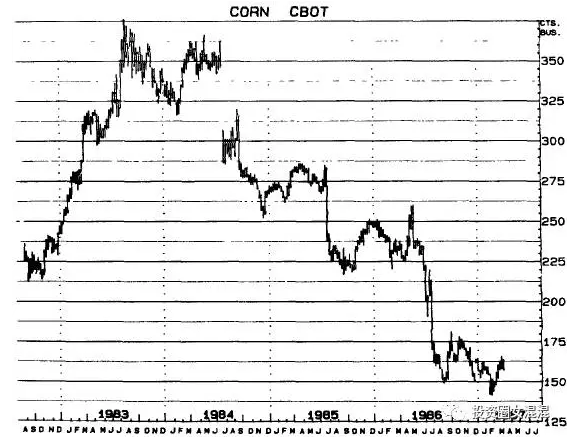

Even a cursory examination of the long-term (weekly) corn chart (Figure 11 – 1) makes it obvious that the market topped out around the 3.75 level in mid-1983. But, as they say, hindsight has 20-20 vision. How would the trader have known this was a top? He couldn’t have known at the time. Until the failure of the rally around the 3.62 level, in second-quarter 1984, the market still looked like a bull trend undergoing a normal technical correction. The failure of the rally against this 3.62 level was confirmation of the top. The relevant question remains – how should a trader have played this situation? More precisely, when and where would he have gotten short? In truth, you would probably get as many answers to that question as the number of people you asked. It might be of interest to examine exactly what signals were given by one of the long-term computer systems during that period (prices basis 91-day perpetual).

只要粗略看过玉米长期趋势图(周线,图11-1),也可以明显知道市场在1983年年中于3.75附近做头反转。但是就像人门所说的,事后再看大家都会,但在当时,交易者怎么知道那是个头部?当时他可能不知道。直到1984年夏季,3.62附近反弹失败时,市场看起来仍然像是多头趋势正在进行正常的技术性回调。3.62反弹失败,确认头部形成。但是,我们还是有相关的问题——在这种情况下,交易者应该怎么玩?说得更明确点,他应该在什么时候和什么地方做空?事实上,你把这个问题拿去问多少人,就会有多少个答案。也许大家有兴趣来看看,某个长期电脑交易系统在这段时间内所发出的信号(91天的连续价格)。

图11-1 玉米(最近期)长期周线图

From a long-term perspective, corn actually topped out at the 3.75 level in mid-1983, but we had no way of knowing this was the reversal. Actually, the top was confirmed on the failure of the rally against the 3.62 level in mid-1984. For the next two years, it was a bear trend, punctuated with occasional minor-trend rallies. The tong-term computer systems began signaling sell on May 1, 1984.

从长期的观点来看,玉米实际上在1983年年中于3.75处做头反转,不过当时我们绝对没办法知道这是个反转。实际上,1984年年中,往3.62反弹不成,头部才确立。接下来的两年,是空头趋势,中间偶见小幅反弹。1984年5月1日,长期电脑交易系统开始发出卖出的信号。

These three trades covered the 18 months from May 1, 1984, through October 31, 1985. Analyzing them in terms of trend and holding period, trade A was the initial short trade signaled as the market emerged from its major top area on May 1, 1984. This short position was held just under 10 months, with the system's trailing stop following the market down. The stop was touched off on the rally of March 22, 1985, and the position was covered and switched to long (trade B). The firmness proved to be temporary (although one had no way of knowing this at the time the short was covered). When the downtrend reasserted itself, the sell stop once again did its job, closing out the long position and reentering short (trade C), which was held for 5.5 months. The profits and losses as well as the length of holding periods speak for themselves.

这三笔交易发生在1984年5月1日——1985年10月31日,共18个月,以趋势和持有期来看,交易A是1984年5月1日市场由大头部区冒出后,信号告诉我们初步做空的交易。这个空头仓持有将近10个月,随着市场下跌,系统不断要我们把止损点往下移。1985年3月22日的反弹,触及所设的止损点,空仓只好平掉,改做多(交易B)。市场上涨证明只是暂时性的(但是当时没办法知道这一点)。下跌趋势再度确立时,卖出止损再度发挥作用,要我们平掉多头仓,再做空(交易C),并持有5个半月。持有时间长短和对应的利润或亏损,数字自己会说话。

Perhaps some trader can come up with better results by following the so-called news, pit gossip, and fundamental statistics – but, I’ve never seen it happen, at least not on any consistent basis, and I won’t believe it until I see it.

也许有些交易者可以依照所谓的消息,柜台前的小道消息,基本面的统计数字,做出比上述更好的成绩——但是,我从没见过这种事情,至少没有经常见到,而且在我真的见到之前,绝不相信有这种事。

No discussion of market action versus market price can be complete without some reference to El Nino. (The literal translation from the Spanish is “the little boy.” For a little boy, he sure throws his weight around.) As all you soybean watchers know, El Nino is a powerful, periodic current of warm water that flows southward along the coast of Peru and can disrupt the normal weather in that part of the Pacific. In altering the ocean temperature along the Peruvian coast, El Nino can kill or drive away marine life and, in this respect, can directly affect the size of the Peruvian anchovy catch. So, what have anchovies got to do with soybean prices on the Board of Trade? Just this-anchovy is the principal ingredient in fish meal, which is a principal competitor of soybean meal in world markets.

如果不谈厄尔尼诺现象(来自西班牙语,字面意思是小孩,也叫圣婴现象。),市场趋势相对于市场价格的讨论绝不算完整。所有注意黄豆市场的人都知道,厄尔尼诺现象是一股强大,定期出现的暖流,往南沿着秘鲁沿岸流动,能扰乱附近太平洋的正常气候。厄尔尼诺现象使得秘鲁沿岸的气候变化不定,可以杀死或赶走海洋生物,并直接影响秘鲁凤尾鱼的捕获量。凤尾鱼捕获量跟芝加哥交易所的黄豆价格有什么关系?当然有关系,凤尾鱼是鱼粉的主要成分,鱼粉在国际市场上则是黄豆粉的主要竞争产品。

If this is beginning to sound a bit fishy, just talk to any soybean analyst. He’ll probably offer an involved and geographic or climate-oriented explanation about where and when El Nino will next strike, sending world soybean prices either soaring or reeling (meal and oil will be affected as well).

如果你觉得这事听起来有点难以令人置信的话,那你不妨随便找一位黄豆分析师来谈谈就知道了。他可能会巨细无遗地,从地理或气候的观点,告诉你厄尔尼诺现象何时在何处出现,结果造成黄豆市场飙升或者下降。(谷物和油会互相影响)。

I have seen lengthy and intricate written studies concerning El Nino, most of which were far too involved to be meaningful to traders. So I have devised my own simple and direct technique for forecasting the presence or absence of EN in any given year.

我见过关于厄尔尼诺现象的文章,写的很复杂,很冗长,大多内容对交易者来说是没有意义的。所以我就自己设计了一整套简单和直接的技巧,用来预测每一年厄尔尼诺现象会不会存在。

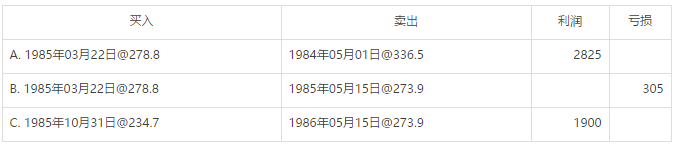

I have eschewed any use or reference to climate analysis, histograms, or meteorological observations in my analysis. On what basis, then, do I set up my forecast for EN? I do it on the basis of price action, and here’s how. Referring to the long-term monthly soybean chart (Figure 11 – 2), the market has generally fluctuated within the range of $4.00 to $10.00 over the past 15 years. Any time the market is in the upper portion of that range, say above $8.00, you can count on EN to be in action (or at least, they’ll say EN is in action). Any time the market is in the lower portion of this broad range, say under $5.50, EN will be nowhere in evidence. From its base area, a nearest-month close over $6.50 would be quite bullish, and would undoubtedly be accompanied by authoritative predictions for an EN of significant proportions. Conversely, following a big bull market into the $9.00 or higher level, a nearest-month close below $7.50 would likely be the cue for EN to scoot off somewhere else in the vast Pacific, leaving the anchovy crop to multiply and prosper. This would undermine the price offishmeal and ultimately soybeans via the reverse process.

在我的分析中,避开了气候分析,柱状图或气象观察方面的资料。那我是用什么方法去预测厄尔尼诺现象呢?我是用价格变动来预测,下面是我的具体方法。从黄豆长期月线图(图11-2)来看,过去15年内,市价大致是在4.00元到10.00元之间上下起伏。任何时候,只要市场处在这个区间的上半部,比如说是8元,你就可以猜厄尔尼诺现象正在发生作用(或至少“他们”会说厄尔尼诺现象发生了作用。)任何时候,只要市价处在区间的下半部,比如说是5.50元,厄尔尼诺现象根本看不到。以底价起算,最近期月份收盘价超过6.50元,就可以说是相当有多头气势,毫无疑问地就会有一些权威人士预测厄尔尼诺现象发生了很显著的影响力。相反的,如果大多头市场冲到9.00元或更高的价位,最近期月份收盘低于7.50元,可能预示厄尔尼诺现象在庞大的太平洋某个地方溜走,导致凤尾鱼数量大增。这会压低鱼粉价格,最后则会促使黄豆价格上涨。

图11-2 黄豆(最近期期货)长期月线图

With its vast public and professional participation, the soybean market creates more instant millionaires with every bull market than any other bull or bear market in any commodity. The ingredients for a big bull market exist any time the market gets below 5.50 and subsequently rallies above 6.50 on a closing basts. The price creates the news, with bullish news and gossip on the rallies and bearish news and gossip on the reactions.

黄豆市场有庞大大众和专业人士参与,每一次多头市场创造的百万富翁数目,比其它任何商品的多头或空头市场创造的数目都要多。只要市价跌到5.50以下,接着收盘反弹到6.50以上,就有一段大多头市场会出现。价格创造了消息:上涨趋势会有多头消息和小道消息出现;下跌时则有空头消息和小道消息出现。

By the way, if you have never witnessed the floor action on the Chicago Board of Trade during a bona fide soybean bull market, you have a real experience to look forward to ( A bull market in soybeans is generally not confirmed until the market can advance out of its base and surpass the 6.50-7.00 level.). A bull market in beans is the granddaddy of all bull markets. It is well worth your trip to Chicago to watch the pyrotechnics from the gallery. Your broker might even be able to arrange for you to tour the floor while you are there. Incidentally, if (or when) we do get such a soybean bull market, you’ll undoubtedly see me, from time to time, either in the gallery or down on the floor watching the powerful frenzy as if for the first time-although, in truth, I’ve been down there quite a bit more often than that. It’s there on the floor and in the pit action that you’ll learn another side of the real story of futures speculation.

顺便说一下,在真正的黄豆多头市场期间内,如果你没有亲眼见过芝加哥交易所营业厅内的状况,那你一定要去看一次(黄豆的价格一旦突破6.50——7.00的水平,黄豆多头市场就开始了。)。黄豆的多头市场,是所有多头市场里面最壮观的。值得你抽时间到芝加哥,从走道上观赏那有如烟火冲天般的壮观。如果你到了现场,经纪人有可能安排你到营业厅内走一遭。如果真的这样,你一定可以在里面看到我,不管是在走道上,还是在营业厅内,观赏那从未见过的疯狂场面。不过,说老实话,我经常出现在那里,并不只是碰到那么盛大的场面才会在场。你必须到营业厅和柜台附近,才能真正了解什么叫做期货投机。

(点击图片查看详情)

每日精彩,欢迎扫描二维码关注期乐会微信公众平台。

感谢作者辛苦创作,部分文章若涉及版权问题,敬请联系我们。

纠错、投稿、商务合作等请联系邮箱:287472878@qq.com